From Interesting Projections to a Real Retirement Strategy

AI retirement planners are powerful.

They can show you numbers, charts, probabilities, and scenarios that would have taken hours—or days—to calculate just a few years ago.

But here’s the problem many people run into:

They get information, but not direction.

They see projections, but they don’t know what to do next.

That’s because AI tools are not meant to replace strategy. They are meant to support it.

The smartest way to use an AI retirement planner is not to trust it blindly—or ignore it completely—but to use it as part of a guided process.

Let’s walk through what that actually looks like.

Step 1: Use AI to Ask Better Questions

One of the biggest benefits of AI retirement planners is not the answers they give—it’s the questions they help you ask.

Before AI, many people didn’t even know what to question.

AI tools help surface questions like:

- Can I really afford to retire when I think I can?

- What happens if markets underperform?

- What if I live longer than expected?

- How sensitive is my plan to inflation?

- How much risk am I actually taking?

These are the right questions.

AI doesn’t replace thinking—it prompts better thinking.

Step 2: Use AI to Understand Possibilities (Not Promises)

AI retirement planners are excellent at showing ranges, not certainties.

They help you see:

- Best-case outcomes

- Worst-case outcomes

- Most-likely scenarios

This shifts your mindset from:

“Will this work?”

To:

“Under what conditions does this work?”

That’s a huge improvement.

Understanding possibilities helps you prepare for uncertainty instead of being surprised by it.

Step 3: Use AI to See Potential Outcomes Clearly

AI tools shine when it comes to visualization.

They can show:

- How long your money might last

- When risks increase

- Where plans break down

This clarity is empowering—but it can also be misleading if taken at face value.

Why?

Because projections are not strategies.

Where Most People Go Wrong With AI Tools

Here’s the common mistake:

People see a projection they like—and stop there.

They assume:

- The assumptions are reasonable

- The plan is realistic

- The strategy is sound

But AI does not tell you if:

- Your assumptions are conservative enough

- Your plan is compliant with regulations

- Your income strategy is sustainable

- Your risk exposure matches your comfort level

This is where professional guidance becomes essential.

Step 4: Work With an Advisor to Validate Assumptions

Every AI output is built on assumptions.

Examples include:

- Market returns

- Inflation rates

- Spending levels

- Tax treatment

- Retirement age

An advisor’s first job is to stress-test those assumptions.

They ask:

- What if returns are lower?

- What if expenses rise?

- What if taxes change?

- What if retirement timing shifts?

This validation step prevents false confidence.

Step 5: Build Compliant, Real-World Strategies

AI can show you what might work.

A licensed advisor helps determine what is appropriate.

This includes:

- Regulatory compliance

- Suitability standards

- Tax-aware planning

- Risk management

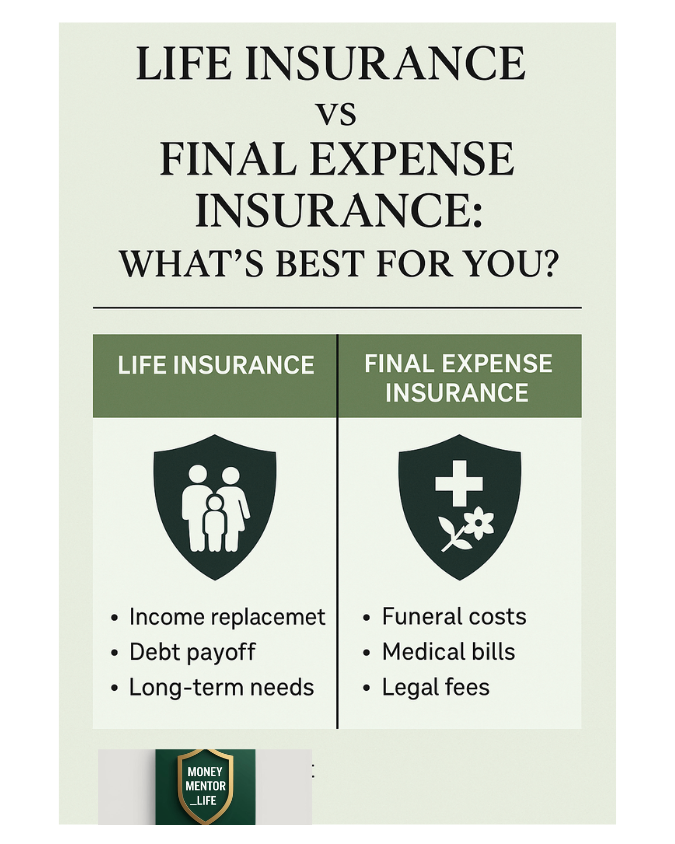

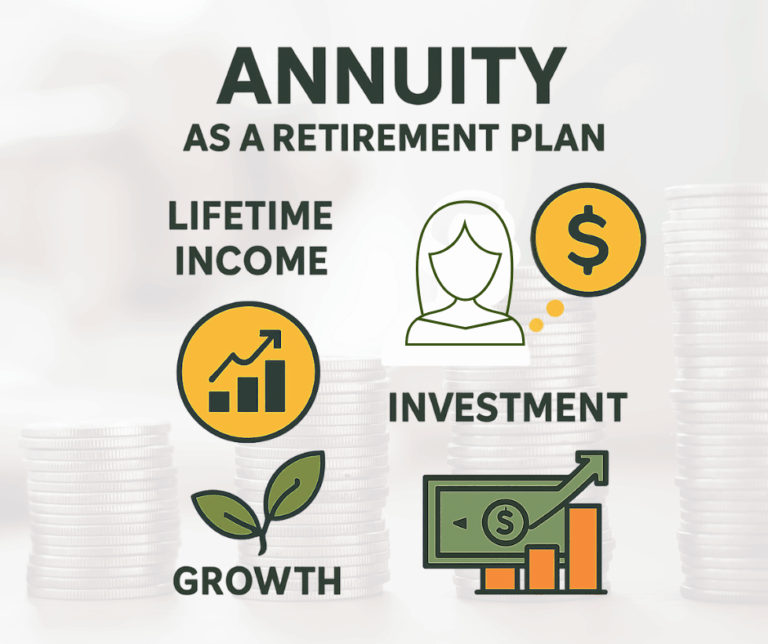

Especially in areas like:

- Insurance

- Annuities

- Retirement income strategies

Compliance is not optional—and AI does not enforce it.

Step 6: Turn Projections Into Income

This is the most important step—and the one AI cannot complete on its own.

Retirement planning is not about balances.

It’s about income.

Advisors help convert projections into:

- Sustainable withdrawal strategies

- Income streams

- Risk-managed distributions

This is where theory meets reality.

Why This Hybrid Approach Works

Using AI with an advisor combines:

- Speed + judgment

- Data + experience

- Projections + accountability

AI handles complexity.

Advisors handle responsibility.

This approach:

- Reduces costly mistakes

- Improves confidence

- Creates flexibility

What a Real Retirement Strategy Looks Like

A real strategy:

- Adjusts as life changes

- Accounts for taxes and regulations

- Manages risk, not just returns

- Prepares for uncertainty

AI helps design it.

Advisors help you live it.

California Retirement Calculator

Your Projection (inflation-adjusted)

- Years to retirement: —

- Projected nest egg at retirement: —

- Income from portfolio (per month): —

- + Social Security (per month): —

- Estimated taxes (per month): —

- Estimated take-home (per month): —

What this assumes

- Contributions and returns compound monthly.

- Returns are converted to “real” (after inflation) for purchasing-power comparisons.

- SWR is applied to the inflation-adjusted nest egg.

- This is an educational estimate, not financial advice.

Who This Approach Is Best For

This approach is ideal if you:

- Already use AI or online calculators

- Want clarity but not guesswork

- Value independence but also guidance

- Prefer informed decisions over assumptions

It’s especially important if you’re:

- Within 10–15 years of retirement

- Planning early retirement

- Managing multiple income sources

The Biggest Benefit: Confidence Without False Certainty

The goal is not to eliminate uncertainty.

That’s impossible.

The goal is to understand it, prepare for it, and manage it.

AI alone can’t do that.

Human guidance alone can’t do it as efficiently.

Together, they can.

If you’re wondering how AI compares to human advisors, check out AI Retirement Planner vs. Traditional Advisors: Which is Right for You?.

Key Takeaway

Use AI to explore.

Use advisors to decide.

Use both to retire with confidence.

If you’re using AI tools but want a real retirement strategy,

let’s review it together.

A second set of trained eyes can:

- Validate your assumptions

- Identify hidden risks

- Turn projections into income

You don’t need to start over.

You just need guidance.

Frequently Asked Questions (FAQ)

Should I trust an AI retirement planner?

You should trust AI tools for analysis and scenarios—not for final decisions. They work best when reviewed with professional guidance.

What should I bring to a retirement plan review?

Bring:

- Your AI projections

- Assumptions used

- Questions or concerns

These make the review more productive.

Can an advisor work with AI-generated plans?

Yes. Many advisors use AI themselves and can interpret third-party projections.

Why isn’t AI enough on its own?

AI lacks judgment, compliance oversight, and emotional context. Retirement planning requires all three.

Is it too late to review my plan if I’m close to retirement?

No. In fact, it’s more important to review plans as retirement approaches.

Do I need to stop using AI tools if I work with an advisor?

No. AI tools are valuable when used correctly and discussed openly.

What’s the biggest mistake people make with AI retirement tools?

Treating projections as guarantees instead of possibilities.

What’s the smartest next step after using an AI retirement planner?

Have your plan reviewed by a licensed professional who can turn insights into strategy.

What’s the bottom line?

AI shows you what could happen.

A real strategy prepares you for what does happen.