Understanding the Basics of Life Insurance

Life insurance is a foundational element of financial planning. It’s designed to protect your loved ones financially after your passing. Whether you’re looking to replace income, pay off debts, or leave a legacy, life insurance plays a vital role.

What Is Life Insurance?

Life insurance is a contract between you and an insurance company. You pay premiums, and in return, the insurer pays a death benefit to your beneficiaries when you pass away.

Life Insurance explained: types, benefits, costs, and how to choose the right policy

Types of Life Insurance Policies

There are several types of life insurance to consider, each suited to different needs.

Term Life Insurance

- Offers coverage for a fixed period (10, 20, or 30 years)

- More affordable, with higher coverage

- No cash value

Term Life insurance explained for beginners and first-time buyers

Whole Life Insurance

- Lifetime coverage with fixed premiums

- Accumulates cash value

- More expensive than term policies

Whole Life Insurance explained for beginners and first-time buyers

Universal Life Insurance

- Flexible premiums and death benefits

- Includes savings component

- Ideal for advanced estate planning

Check why more people are buying life insurances in California. And learn what is estate planning and what to know before buying trust and will packages.

What Is Final Expense Insurance?

Final expense insurance, also known as burial insurance, is a smaller policy designed to cover end-of-life costs such as funeral expenses, medical bills, and legal fees.

Definition and Purpose

This type of insurance ensures your loved ones aren’t burdened by the cost of your funeral and other minor debts.

Common Features of Final Expense Insurance

- Coverage amounts usually range from $5,000 to $25,000

- Easier to qualify for (even with health conditions)

- Whole life policy – doesn’t expire as long as premiums are paid

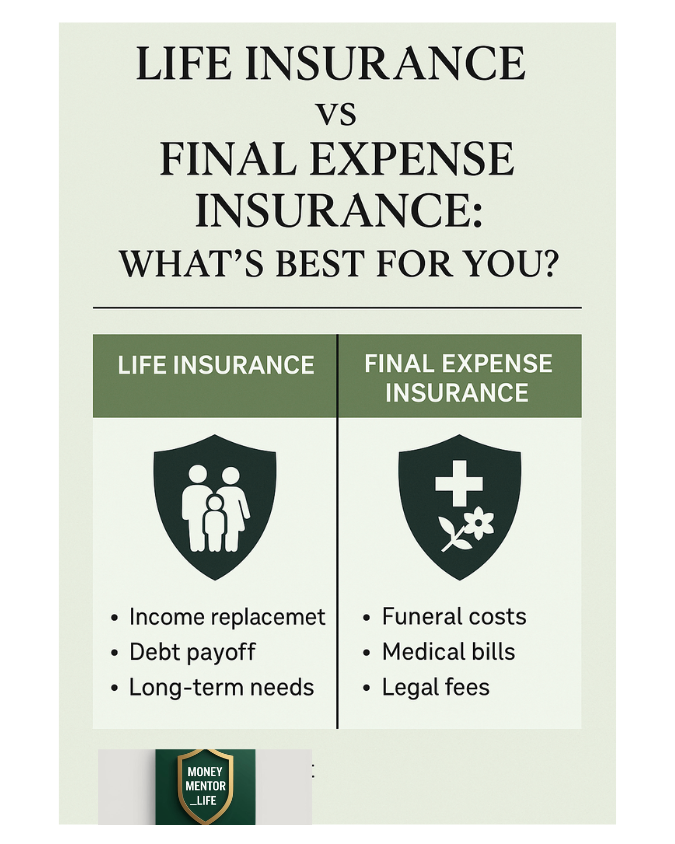

Key Differences: Life Insurance vs Final Expense Insurance

Coverage Amounts

- Life Insurance: Ranges from $50,000 to several million dollars

- Final Expense: Typically $5,000 to $25,000

Policy Cost and Premiums

- Life insurance premiums are based on age, health, and coverage amount

- Final expense premiums are lower due to smaller coverage, but cost per dollar of coverage is higher

Underwriting and Qualification

- Life insurance may require a medical exam

- Final expense policies often use simplified issue or guaranteed acceptance

Intended Purpose of Benefits

- Life insurance supports dependents, mortgage, and long-term needs

- Final expense insurance covers immediate after-death costs

Who Needs Life Insurance?

Best Scenarios for Life Insurance Policies

- Parents with minor children

- Homeowners with a mortgage

- High earners with dependents

- Anyone with long-term financial obligations

How much life insurance do I need? Do you know how much money you will need in your retirement?

Cost Comparison Table: Life Insurance vs Final Expense

| Feature | Life Insurance | Final Expense Insurance |

|---|---|---|

| Coverage | $50,000 – $1,000,000+ | $5,000 – $25,000 |

| Term Length | Fixed or lifetime | Lifetime |

| Medical Exam | Often required | Usually not required |

| Ideal For | Income replacement, debt payoff | Funeral and small debts |

| Premiums | Lower per $ of coverage | Higher per $ of coverage |

How to Choose the Right Policy for Your Needs

Choosing the right policy depends on your:

Financial Situation

- Large debts = life insurance

- Only need funeral coverage = final expense

Age and Health Condition

- Younger and healthy = term or whole life is better value

- Older or have medical issues = final expense may be more accessible

Family and Dependents

- If you have dependents relying on your income, life insurance is essential

A licensed financial planner can help you choose the right policy and options for your needs. Read how to find a local financial planner. Or contact us to explore your options.

lifeinsurancevsfinalexpense by Sonal PateliaBenefits of Having Either Policy

- Peace of mind for you and your family

- Ensures financial protection

- Prevents loved ones from dipping into savings to cover your final needs

- Can be used for legacy or charitable giving

Common Myths About Final Expense Insurance

- “It’s a scam” – No, it’s a real product for specific needs.

- “I’m too old to get coverage” – Many policies accept applicants up to 85.

- “I don’t need it if I have savings” – Unexpected expenses can still arise.

Do you know you need to avoid probate in California? Find this valuable resource about estate planning in CA.

FAQs About Life and Final Expense Insurance

1. Can I have both life and final expense insurance?

Yes, many people do. Life insurance covers big expenses, while final expense handles end-of-life costs.

2. What happens if I outlive my term life policy?

It expires. You may have the option to renew or convert it, but premiums will rise.

3. Does final expense insurance build cash value?

Yes, it’s a type of whole life policy and may accumulate a small cash value.

4. Can my family use the death benefit for anything?

Yes, funds can be used for any purpose unless stated otherwise.

5. How fast is the payout?

Final expense policies often pay out faster, sometimes within days after death.

6. Can I change beneficiaries later?

Absolutely. You can update beneficiaries anytime by contacting your insurer.

Choosing What’s Best for Your Peace of Mind

The decision between life insurance vs final expense insurance comes down to your financial goals, age, health, and family situation. Life insurance offers broader financial protection, while final expense insurance ensures your loved ones aren’t left with the burden of funeral costs. In many cases, a mix of both can provide the ideal safety net.