When considering life insurance, one of the biggest questions people ask is: “How much coverage do I really need?” The answer isn’t one-size-fits-all. But the DIME Method is a smart, easy-to-remember formula to help you get a reliable estimate based on your actual life responsibilities.

🧮 What Is the DIME Method?

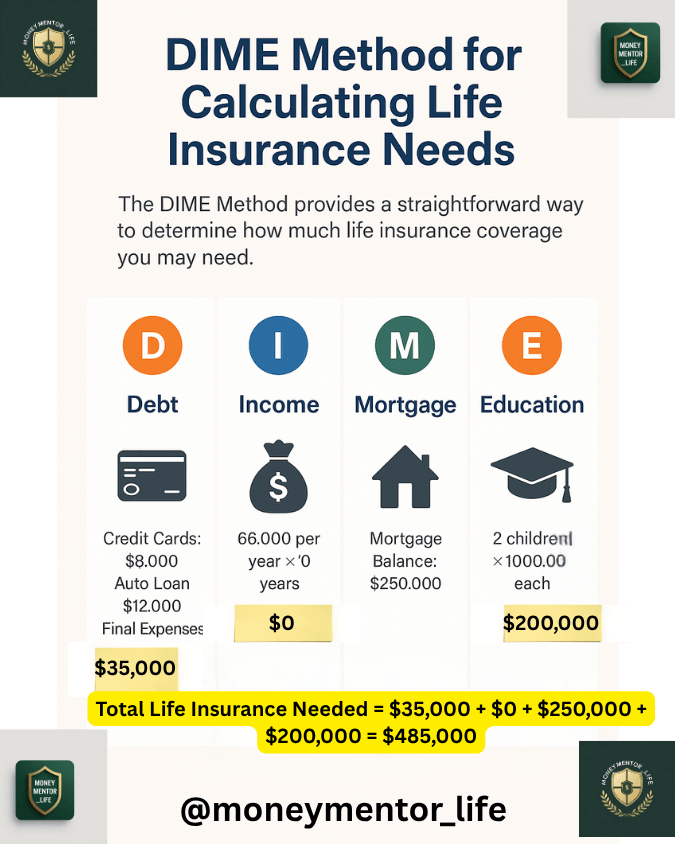

DIME stands for Debt, Income, Mortgage, and Education—four key areas where your family would need financial support in your absence.

Let’s walk through a real-life example to see how this works. Or use this interactive calculator with your own numbers.

Easy Life Insurance Need Calculator [DIME Method]

Your Estimated Life Insurance Need (DIME)

This is a simplified estimate. Review with a licensed financial professional.

🧾 Example Breakdown: How Much Coverage Is Enough?

Let’s say you’re evaluating your life insurance needs. Here’s what you’d include under each DIME category:

Why 40-somethings are buying life insurance more than ever now?

🔶 Debt

- Credit Cards: $8,000

- Auto Loan: $12,000

- Final Expenses (funeral, burial, etc.): $15,000

➤ Total Debt = $35,000

🔵 Income

- You earn $66,000 per year.

- Your spouse doesn’t depend on your income, so you choose 0 years of income replacement.

➤ Total Income Replacement = $0

🟢 Mortgage

- Outstanding mortgage balance: $250,000

➤ Mortgage = $250,000

🟠 Education

- Two children × $100,000 each = $200,000

➤ Education = $200,000

✅ Final Insurance Need:

$35,000 (Debt) + $0 (Income) + $250,000 (Mortgage) + $200,000 (Education) = $485,000

So, you would look for a policy that covers at least $485,000.

🧠 Why This Matters

Without life insurance, your loved ones could be left facing bills, mortgage payments, and college tuition without your financial support. The DIME Method ensures nothing is left out—and gives your family a safety net when they need it most. This DIME method is used by many financial industry leaders, such as investopedia , insurance-marketing agents and HGI group.

🧑💼 How a Financial Planner Can Help

While the DIME Method offers a great starting point, a licensed financial planner can help you:

- Factor in inflation and interest rates

- Balance term vs. whole life insurance

- Integrate your policy with other assets and retirement plans

- Adjust coverage over time as your income, debts, or family changes

A good planner will not “sell” you a product—they’ll build a protection plan tailored to your values and goals. Find out the best licensed financial planner in your area using this tips.

📌 Final Tip

Even if you’re not ready to purchase a policy today, knowing your DIME number gives you clarity. You’re not guessing—you’re planning with purpose. Planning becomes easier when you can use simple, free planning spreadsheet, like this one.