In today’s fast-moving world, finding the right Financial Solution is key to building stability and confidence. This blog post highlights how a well‑designed strategy can integrate planning, investment, insurance, and debt management to guide individuals toward lasting financial wellness.

A successful Financial Solution begins with setting clear goals. Whether you’re saving for a dream home, planning for retirement, or reducing debt, a customized roadmap helps prioritize actions and track progress. A well-thought out plan can help align short‑term milestones with long‑term ambitions to keep momentum strong.

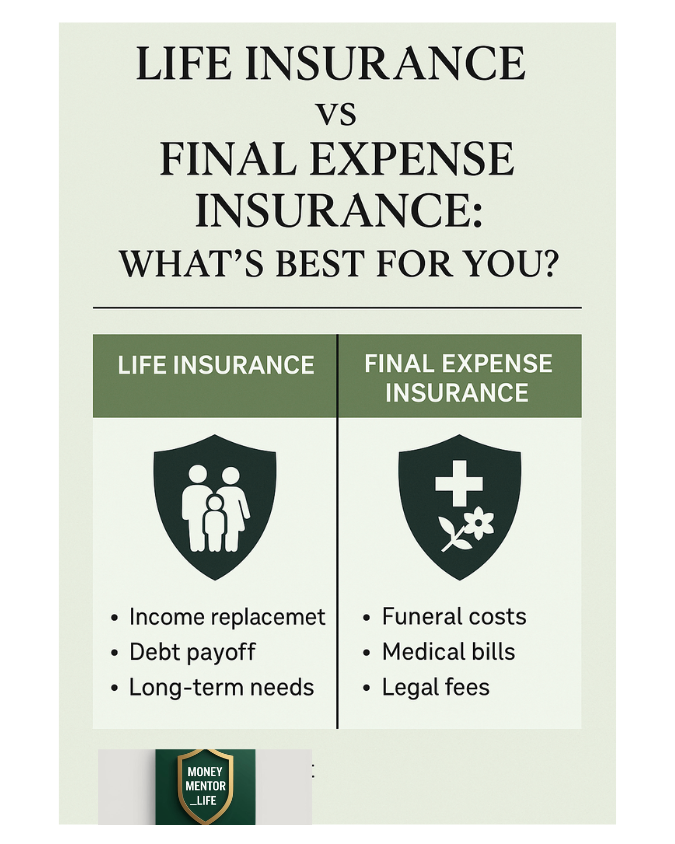

Diversification is another cornerstone. Spreading resources across savings, investment vehicles, and protection tools ensures resilience. Simple steps such as establishing emergency reserves, selecting balanced investment portfolios, and opting for cost-effective insurance can build a hedge against uncertainties.

Smart debt management is equally crucial. Techniques like refinancing high-interest loans and consolidating credit lines to reduce costs and streamline payments. These tactics free up monthly cash flow, which can be redirected toward wealth-building or savings.

California Retirement Savings Calculator

California Retirement Calculator

Your Projection (inflation-adjusted)

- Years to retirement: —

- Projected nest egg at retirement: —

- Income from portfolio (per month): —

- + Social Security (per month): —

- Estimated taxes (per month): —

- Estimated take-home (per month): —

What this assumes

- Contributions and returns compound monthly.

- Returns are converted to “real” (after inflation) for purchasing-power comparisons.

- SWR is applied to the inflation-adjusted nest egg.

- This is an educational estimate, not financial advice.

Moreover, automation boosts financial discipline. Financial advisors encourage setting up recurring transfers to savings, investment plans, and bill payments. Automating these steps helps individuals stay on track without constant manual oversight.

The Rule of 72 is a simple way to predict how fast your savings can grow, which connects directly to planning around Social Security income.

Finally, regular review and adjustment is important. Life stages change—marriage, career shifts, or health events—so revisiting your Financial Solution annually (or after major milestones) ensures it remains relevant and effective. It is important to start talking to a local financial planner to manage your money.

A robust Financial Solution combines thoughtful goal‑setting, smart diversification, debt control, automation, and periodic reviews. It’s not just about accumulating money—it’s about designing a flexible system that adapts as life evolves. With these steps, anyone can pave a clear path toward financial peace and prosperity.