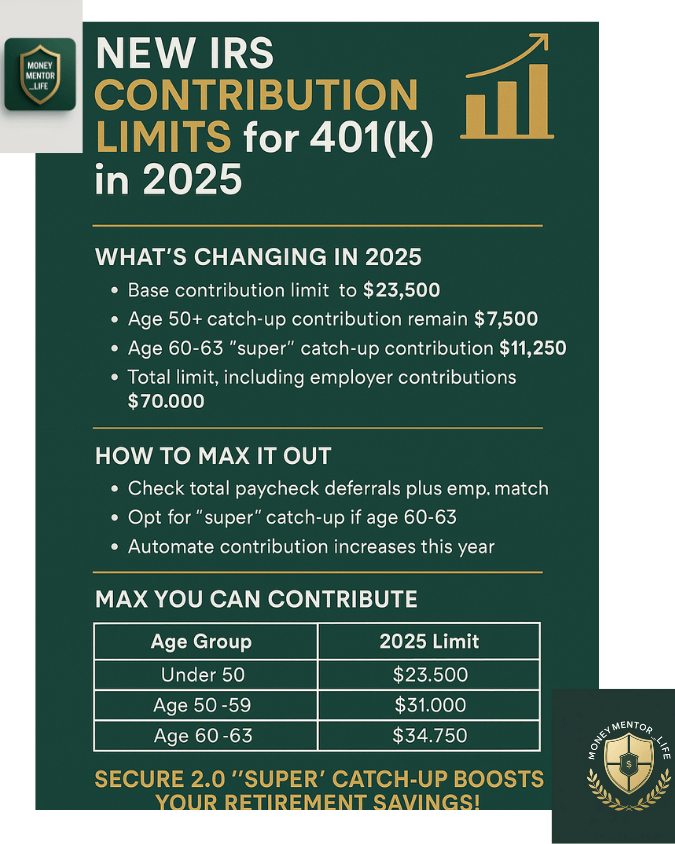

If you’re searching online for new IRS contribution limits for 401(k) in 2025, you’re in the right place. Here’s what real people want to know—what’s changed, who benefits, and how to take advantage before the year ends.

🗓 What’s New in 2025?

- Base contribution limit for 401(k), 403(b), 457, and TSP plans jumps from $23,000 to $23,500. irs.gov

- Catch-up contribution for ages 50+ remains at $7,500. As per IRS.GOV

- Super catch-up for ages 60–63 increases to $11,250, boosting your total potential contribution to $34,750. Read more in this article.

- Total combined limit (including employer contributions) climbs to $70,000.

🧠 Why This Matters to You

- If you’re in your 50s or early 60s, this is your chance to ramp up savings. Your income may be peaking and time is running out.

- These updates come from SECURE 2.0, aimed to help older workers “supercharge” retirement funding. This investopedia article lists new changes.

- Despite the increase, only about 14% of households max out their 401(k)—don’t miss out.

📌 How to Use This Info

| Age Group | Max You Can Put In (2025) |

|---|---|

| Under 50 | $23,500 |

| Age 50–59 | $31,000 |

| Age 60–63 | $34,750 |

- Check your total paycheck deferrals and employer match.

- If you’re 60–63, choose the super catch-up option instead of the regular $7,500 catch-up.

- Automate your contribution increases now—even 1% extra boosts your nest egg.

🏁 What’s Ahead This Year

- Catch-up and super catch-up are opt-in—check if your plan supports them.

- Employer match and after-tax contributions still count toward the $70k total, so consult your plan admin.

- Other key changes under SECURE 2.0, like auto-enrollment and part-time worker inclusion, are also rolling out.

As year end nears, it is important to review your retirement planning. Licensed financial planners are really helpful to find out best tax-savings plans.

✅ Bottom Line

The new IRS contribution limits for 401(k) in 2025 are a rare opportunity to accelerate your retirement savings, especially if you’re over 50. Mid-career Californians should:

- Max out the base limit

- Use catch-up or super catch-up if eligible

- Automate those extra contributions before year-end

Need help customizing this for your paycheck?

Visit our [Contact Us] page or try our [Reti