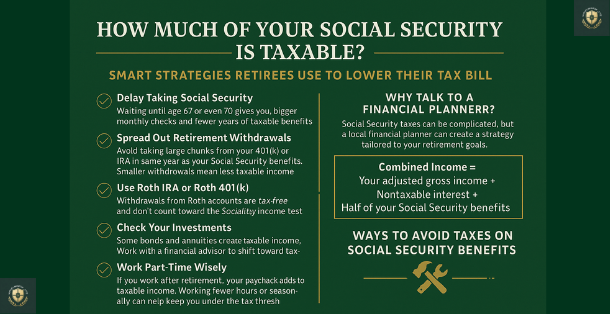

Social Security benefits are a major source of income for retirees, but many people don’t realize that up to 85% of their benefits may be taxed. The good news is, with smart retirement planning, you can reduce or even avoid paying taxes on Social Security income.

Before diving in, it helps to understand the full retirement picture. Our Retirement Planning Pillar breaks down Social Security, income strategies, timelines, and smart decisions so you can retire with confidence.

This guide explains how much of your Social Security is taxable and the best strategies to keep more money in your pocket

📊 How Much of Your Social Security is Taxable?

The IRS uses something called “combined income” to decide how much of your Social Security is taxable.

Combined Income = Your adjusted gross income + Nontaxable interest + Half of your Social Security benefits.

Here’s a simple breakdown:

Suppose you’re a single with:

- AGI = $30,000 (excluding Social Security)

- No nontaxable interest

- Annual Social Security = $20,000

Combined Income = $30,000 + $0 + ($20,000 ÷ 2) = $40,000

- Threshold for taxation (single)

- Up to 50% up to $34,000

- Over $34,000: up to 85%

So you’re in the highest tier—up to 85% of your benefits may be taxed. Learn how to calculate taxes on social security benefits.

New IRS Contribution Limits for 2025

Smart retirement planning combines Social Security decisions with the Rule of 72 to understand how your money works for you.

🛠 Ways to Avoid Taxes on Social Security Benefits

Here are smart strategies retirees use to lower their tax bill:

Delay Taking Social Security

- Waiting until age 67 or even 70 gives you bigger monthly checks and fewer years of taxable benefits.

Spread Out Retirement Withdrawals

- Avoid taking large chunks from your 401(k) or IRA in the same year as your Social Security benefits. Smaller withdrawals mean less taxable income.

Use Roth IRA or Roth 401(k)

- Withdrawals from Roth accounts are tax-free and don’t count toward the Social Security income test.

Check Your Investments

- Some bonds and annuities create taxable income. Work with a financial advisor to shift toward tax-friendly investments.

Work Part-Time Wisely

- If you work after retirement, your paycheck adds to taxable income. Working fewer hours or seasonally can help keep you under the tax threshold.

If you want to see how this topic fits into your bigger retirement strategy— including Social Security timing, income planning, and risk management— explore our complete Retirement Planning Guide.

Leverage Tax-Free Accounts

- Health Savings Accounts (HSA) and other tax-free withdrawals can help cover medical costs without raising your taxable income.

The Rule of 72 is a simple way to predict how fast your savings can grow, which connects directly to planning around Social Security income.

👥 Why Talk to a Financial Planner?

Social Security taxes can be complicated, but a local financial planner can create a strategy tailored to your retirement goals.

They can help you:

- Plan when to claim benefits.

- Reduce taxable retirement income.

- Maximize savings from tax-advantaged accounts.

📞 Take the next step: Connect with a financial advisor near you and start planning smarter for your retirement

📝 Final Thoughts

Your Social Security benefits are meant to support you in retirement. With the right planning, you can avoid unnecessary taxes and keep more of your hard-earned money. Secure your financial future with a tailored financial solution.

By using Roth accounts, spreading out withdrawals, and timing your Social Security wisely, you can create a tax-smart retirement strategy. And remember—working with a licensed financial planner can make all the difference.

✅ Bottom Line

Calculate your retirement income now. Explore strategies like Roth conversions, targeted withdrawals, or using HSAs and QCDs. Leverage OBBB benefits while available (2025–2028). Consult a trusted financial planner—especially to tailor strategies to your income, filing status, timing, and long-term needs.